A LETTER TO KATSINA STATE GOVERNOR ON KATSINA STATE REVENUE BOARD CHAIRMANSHIP.

Assalamu alaikum Sir,

The Screening and Confirmation of Prof. Sani Mashi as the Revenue Board Chairman by The KTHA: The Implications and the Way Forward

Sir, with deep respect for your person, your esteemed position and your dedication to the service of our state, I humbly convey my thoughts on the above stated subject matter. As such, I give you the assurance of the purity of my intentions and the sincerity of my purpose.

In light of the recent developments concerning the screening and confirmation of Prof. Sani Mashi as the Chairman of the Katsina State Board of Internal Revenue, I believe it is pertinent to discuss the implications and propose a constructive path forward.

Your Excellency Sir, I hold in high regard both your intentions and actions in nominating Prof. Sani Mashi as the Chairman of the Katsina State Board of Internal Revenue. It is apparent that your commitment to the betterment of our state is genuine and well-intentioned.

The purpose of this communication is to present an alternative perspective on the legal and ethical ramifications surrounding Prof. Sani Mashi's nomination and subsequent approval by the Katsina State House of Assembly, at least according to my understanding as an Ombdusman and also as a former member of the State House of Assembly. And I do this, knowing full well, that you do not lack qualified people within your immediate circle who might have done that already.

Your Excellency Sir, Prof. Sani Mashi, as a renowned Professor of Geography, does not posses the qualifications as clearly spelt out by both the National Act and the State's Law.

The Fact of The Matter:

The Nigerian Constitution outlines a "concurrent legislative list," encompassing areas wherein both the National Assembly and a State House of Assembly possess a legislative authority. Notably, revenue matters fall within this jurisdiction.

Here, I need to explain that the developers of our constitution foresaw a situation of a possible clash between a law made by the National Assembly and a similar law made by the House of Assembly of a State on the same subject matter. Consequent upon that, Section 4(5) was created in the Constitution to take care of such a situation whenever it arises. The section provides that:

"If any law made by the state House of Assembly of a state is inconsistent with any law made by the National Assembly, the law made by the National Assembly shall prevail, and that other law shall, to the extent of the inconsistency, be void."

The section explains the concept of what, in legal parlance, is known as the Principle of 'Covering the Field'. It simply means that no State House of Assembly can make a law on a subject mater that is inconsistent with a law validly made by the National Assembly which covered the same subject matter.

In this regard, the National Assembly had duly passed a law on revenue known as Personal Income Tax Act (PITA) amendment act 2011. Relevant to our discussion, I refer to Sections 86 and 87 of the Act.

Section 87(2) clearly states that:

"The state board shall comprise -

(a)The Chairman of the State Internal Revenue Service as Chairman of the State Board who shall be a person experienced in Taxation, and a member of a relevant recognised professional body....."

Beforehand, Section 86 provides for the establishment of the 'Joint Tax Board' at the National level. And section 86(2) provides the qualification for membership of the Joint Tax Board from every state of the country. The section provides that:

"The Board shall consist of the following members:

2b. One member from each state being a person appointed pursuant to section 87(2)(a) of this Act. And a nomination under this paragraph shall be evidenced by notice in writing delivered to the Secretary to the Board by the Governor "

In compliance with Section 87 of the National Assembly Act, the Katsina State House of Assembly also passed the Revenue Administration (Codification and Consolidation) law 2021. Section 6(2)(a)(ii) also provides that:

"The Chairman of the Board shall...

(ii) possess membership of relevant and recognised professional body; and

(iii) versed and experienced in taxation "

Your Excellency Sir, I will also respectfully draw your attention to an issue of concern pertaining to the interpretation of Section 13(b) of the Katsina State Revenue Law 2021. Some individuals may attempt to exploit the provision outlined in this section, by raising arguments centered on cognate experience within the ….."social sciences"….. domain as an additional qualification. They might argue that Geography was historically affiliated with the Faculty of Social Sciences, hence asserting the eligibility of Prof. Sani Mashi; a Geography Professor.

I believe it is important to address these assertions, highlighting their legal and procedural misconceptions. It is therefore, imperative to clarify that these arguments lack substantial legal merit and cannot withstand scrutiny, both within the bounds of legality or in accordance with the stipulations set forth by the Core Curriculum and Minimum Academic Standard (CCMAS) of the National Universities Commission (NUC).

The aforementioned section in the Katsina State Revenue Law 2021 specifically refers to the "accountability of the chairman," not his qualifications. This fact is evident from the contextual reference provided by the marginal notes accompanying the section. Assuming their argument were to be upheld as a valid qualification, it is essential to underscore that such an assertion is legally untenable, as this assertion is in direct contravention of the legal principle of “covering the field” laid out in Section 4(5) of the constitution, as explained above. This constitutional provision renders Section 13(b) of the state law to be held in abeyance (suspended) due to its inconsistency with the provision of Section 87(2) of the PITA passed by the National Assembly.

Moreover, the dynamic landscape of educational structuring has necessitated a re-evaluation of the positioning of Department of Geography within University Faculties. The Core Curriculum and Minimum Academic Standard (CCMAS) 2022, of the NUC has reclassified the Department of Geography from Faculty of Social Sciences to Faculty of Environmental Sciences. It is in line with this new restructuring, that esteemed institutions such as ABU and BUK transferred their Departments of Geography from Social Sciences, to Faculty of Physical Sciences and Faculty of Earth and Environmental Sciences, respectively. Notably, UMYU Katsina is also at an advanced stage of implementing a similar shift.

The Implications:

A. Legal Implications

1. The appointment and the subsequent screening and confirmation by the house is illegal as it is in direct violation of the two laws as I quoted above.

2. Prof. Sani Mashi can neither represent Katsina State in the Joint Tax Board nor can he send a representative (PITA - S86(2).

3. Katsina State Government will miss out on deliberations and contributions on national revenue issues during Joint Tax Board meetings.

4. There may likely be a barrage of petitions from the relevant Professional Bodies and Civil Society Organisations.

5. Katsina State House of Assembly does not have the legal power to amend the existing law to accommodate Prof. Sani Mashi because that will make it inconsistent with the National Act (Section 4(5).

B. Moral Implications

1. The appointment of Prof. Sani Mashi without meeting the stipulated criteria could subject the Katsina State Government to national embarrassment.

2. The appointment will question the hard earned integrity of the Government which it has labored and established thus far.

The Way Forward

1. Given the legal and moral considerations, I propose a reconsideration of the current course of action. A qualified candidate should be identified and appointed in accordance with the stipulated requirements.

2. An alternative avenue could involve appointing Prof. Sani Mashi as a Special Adviser for Revenue, where qualifications are not explicitly mandated. This role will give him the added advantage of being a member of the State Executive Council where he will have the opportunity to contribute to other issues concerning other MDAs.

Conclusion

Your Excellency, your dedication and sincerity in your endeavors are undeniable. It is essential to remember that honorable intentions do not serve as a legal foundation for actions that may be considered inconsistent with established norms. The enduring principles that guide our actions should also guide our choices, Sir.

Allah ya yi ma ka jagora (May divine guidance continue to illuminate your path).

Respectfully,

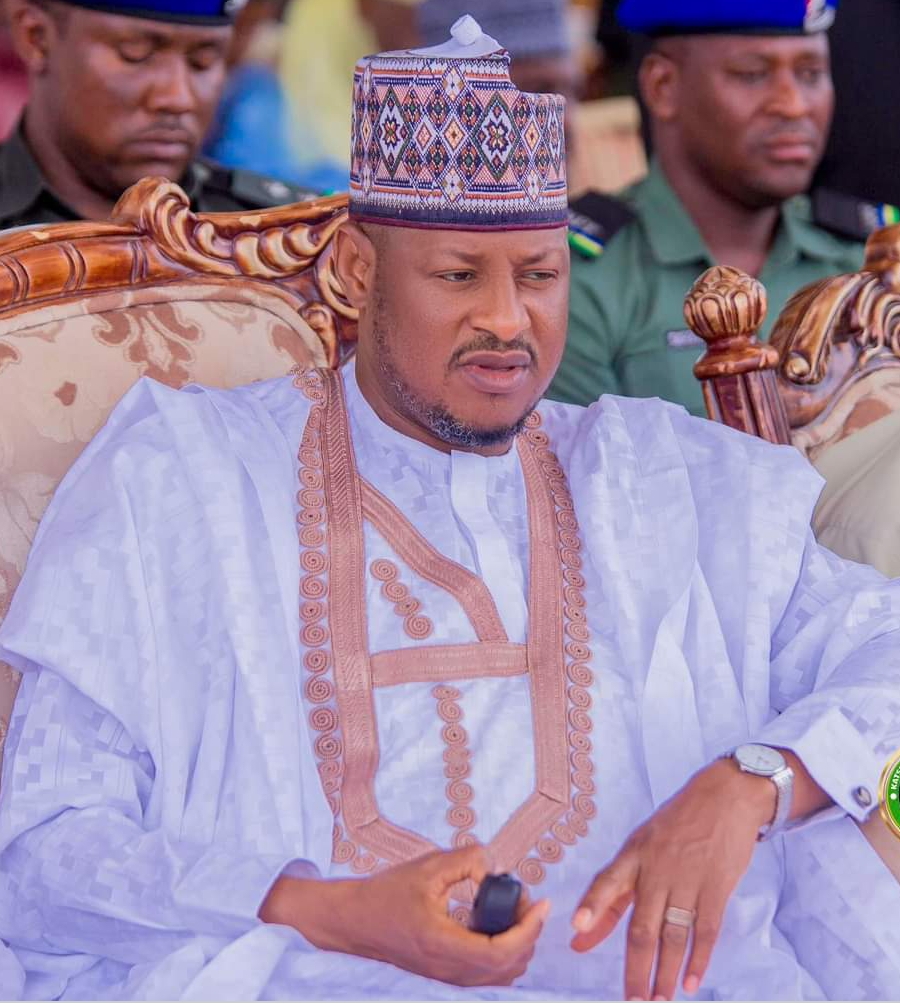

Hon. Abdullahi Ibrahim Mahuta

Federal Commissioner,

Public Complaints Commission,

Katsina State.